Prices of high residential properties in Dubai surged using more than 16 percent last 12 months, marking the second one-fastest increase in growth rate globally, driven via a robust call amidst a broader financial rebound.

According to assets consultancy Knight Frank’s film released on Wednesday, homes valued at $10 million or more in the best neighborhoods like The Palm Jumeirah, Emirates Hills, and Jumeirah Bay Island witnessed remarkable appreciation in 2023.

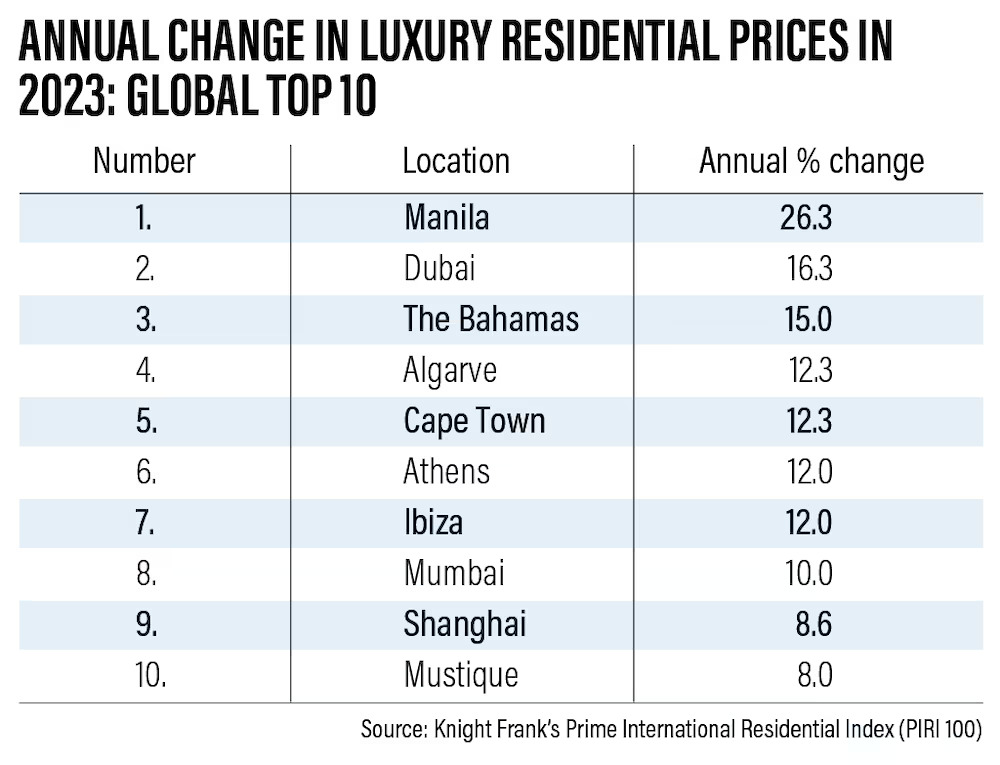

Globally, luxurious residential belongings fees saw an average uptick of 3.1 percent closing year, with Manila main few of the 100 markets surveyed in Knight Frank’s Prime International Residential Index record, registering an extremely good 26 percent surge.

Following Manila, the Bahamas ranked third with a 15 percent boom in costs. The Algarve in Portugal and Cape Town in South Africa rounded out the pinnacle five, each recording increase costs of 12.3 percent.

Faisal Durrani, partner and head of research for the Mena place at Knight Frank, highlighted that the entire inventory of prime homes to be had on the market in Dubai shrank by using 38.5 percent in 2023, mirroring a comparable fashion in income stock in Dubai’s Burj Khalifa, which plummeted through 52 percent over the same length.

Durrani mentioned a shift in house owner behavior, with many opting to hold their residences longer, indicative of a developing desire for lengthy-term residency amongst buy-to-maintain traders. This trend has contributed to sustaining price appreciation in Dubai’s prime actual property market.

Despite the record-breaking luxury home income, Dubai stays positioned towards the lower give up of the spectrum in a number of the world’s most expensive prime markets, the file indicated.

With $1 million securing about 979 square toes in any of the emirate’s three optimal residential districts, Dubai ranked thirteenth on the listing of the sector’s top 15 residential markets.

In contrast, $1 million only buys about 172 square feet of space in Monaco, the pinnacle-ranked luxurious market globally.

“Dubai stays one of the maximum affordable luxury markets worldwide, in addition to enhancing its charm the various global elite dominating the higher echelons of the marketplace” noted Mr. Durrani.

Knight Frank forecasts a 5 percent growth in prime residential values in Dubai this year, positioning the city as the third fastest-growing high residential marketplace globally, trailing at the back of Auckland with a projected increase of 10 percent and Mumbai with 5.5 percent.

In 2023, Dubai’s luxurious domestic market reached extraordinary ranges, with sales of homes priced at $10 million or more nearly doubling to $7.6 billion, outperforming markets in London and New York, according to Knight Frank’s recent report.

While sales inside this charge bracket surged by 91 percent in the final year, approximately a 3rd (28 percent) of the 431 transactions were finished inside the final quarter.

Furthermore, Dubai’s splendid-high market, comprising properties worth over $25 million, additionally witnessed a huge boom, with 56 deals totaling $2.3 billion, doubling the previous 12 months’s overall.

As one of the number one business, tourism, and financial hubs in the Middle East, Dubai has sustained its robust growth momentum following its recovery from the COVID-19-brought-on slowdown. Government data revealed an annual 3.3 percent growth in its economic system in the course of the primary nine months of the final year, pushed with the aid of growth within the tourism and transport sectors.

Emirates NBD anticipates Dubai’s gross home product to extend utilizing 4 percent this year, surpassing the three.3 percent increase is expected for the UAE economic system as an entire.